Commission accounting is essential https://www.intuit-payroll.org/ for a company’s monetary statements, affecting each the earnings assertion and balance sheet. Commission expenses, categorised as working bills, influence profitability and web income. Received commission accounting impacts a company’s financial health. Commission bills immediately have an result on the company’s profitability and must be rigorously managed for correct financial reporting. Correct accounting ensures that solely due commissions are paid, aligning with general monetary objectives.

Late funds negatively have an effect on worker morale and satisfaction. In a competitive sales setting, this could reduce motivation and performance levels among the many sales employees. Lastly, it plays a major role in employee satisfaction.

Whether the fee is acquired in cash, through a bank, or is still receivable, it must be recorded accurately. This article will clarify the means to pass the commission-received journal entry, its accounting therapy, GST influence, and how it’s proven in last accounts and the Tally. Recording commission receivable precisely is crucial for maintaining dependable financial information and guaranteeing the financial statements reflect the true monetary position of the enterprise. By understanding tips on how to create the journal entry for fee receivable, companies can manage their assets and revenues effectively. To journalise obtained fee, we want to report the transaction in the accounting books. The fee acquired is usually considered earnings, and it’ll increase the money or bank account.

What Is Journal Entry For Fee Received?

Accurate fee accounting can motivate gross sales workers to meet and exceed targets. When salespeople know their commissions are tracked correctly, morale is boosted. This is essential for motivating gross sales teams, maintaining monetary accuracy, and ensuring worker satisfaction.

Where Does Fee Receivable Go?

Commission earnings is a typical form of earning in plenty of businesses. When an organization sells goods on behalf of one other, it earns part of the sales worth as a commission. In accounting, we must report this revenue correctly to keep the books correct. This part will clarify what the journal entry for fee obtained is and the way we report it. In summary, understanding and implementing robust systems for sales commission accounting are key to sustaining monetary accuracy and rewarding success inside sales groups. In the preparation of ultimate accounts, commissions are treated based on whether or not they are paid or received.

- The sales rep. must exit and get customers to buy the product and then the enterprise proprietor pays them a commission out of the sale.

- These inaccuracies can further trigger delays in commission payouts.

- The commission is paid by the TTT manufacturers and obtained by employees.

- The property owner pays a commission to the property agent when the property is sold.

Correct recording ensures proper monitoring of earnings and helps maintain clear financial data. GST on Commission Obtained refers back to the Items and Providers Tax applicable on revenue earned through commissions for services rendered or gross sales facilitated. The applicable GST rate is normally 18%, and proper invoicing, assortment, and reporting are important to stay compliant.

It just isn’t essential to report receivables as the cash already receipt. The quantity of commission obtained is dependent upon the contract between the company and the supplier of goods/services. The agency does not liable for the design, production of the goods or providers.

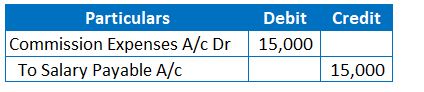

This is normally calculated as a proportion of gross sales made by the agents or partners. Recording fee receivable precisely is essential for maintaining correct financial data and managing anticipated revenues. Salaries are the financial remunerations the business offers to its staff in exchange for his or her companies. Salaries Paid journal entry is passed to report the salary payments to workers by the business. Salaries are treated as an expense in the books of enterprise, so when the salary is paid, the Salary account gets debited and the cash/bank A/c gets credited.

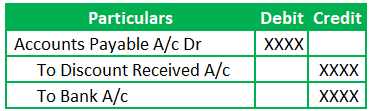

An account used to document commissions received by a company. In a double-entry system, the commissions received account shall be credited and the checking account (or the debtors’ account till it is received) is debited. Commission with GST refers to commission earnings on which Goods and Services Tax is applicable, usually at a standard fee of 18%. When a business or individual earns commission and is registered under GST, they have to charge GST on the amount obtained and problem a correct tax invoice.

The transaction have to be recorded to mirror both the income and the GST legal responsibility, making certain accurate accounting and compliance with GST rules. The treatment of fee obtained in final accounts includes exhibiting it as oblique earnings in the Revenue and Loss Account, which increases the online revenue. If any fee is still receivable at year-end, it’s also shown as an asset underneath Accounts Receivable within the Stability Sheet. The Commission received its earnings and is credited in the journal entry with a corresponding debit to accounts receivable or Financial Institution if no credit score period is allowed for this transaction. The transaction will increase commission receivable on balance sheet by $ 5,000.