For U.S. corporations, the financial unit assumption permits accountants to specific a company’s wide-ranging assets as greenback amounts. Further, it is assumed that the U.S. dollar doesn’t lose its purchasing energy over time. As A Result Of of this, the accountant combines the $10,000 spent on land in 1980 with the $300,000 spent on a similar adjacent parcel of land in 2024.

Company

This was disclosed, as required by GAAP, within the footnotes to the audited financial statements. Today’s selections and belief in investing hinge on clear financial information. Analysis from the last 20 years exhibits how a lot accounting standards affect investment views. Merely put, when an organization reports higher earnings per share (EPS), buyers see extra value in it. They are prepared to pay an extra $5.forty for every greenback improve in EPS.

With Out comparability, monetary knowledge can be a group of disparate facts, akin to an orchard where apples are blended with oranges, making it inconceivable to discern the well being and efficiency of an organization. This principle calls for consistency within the application of accounting policies and standards, not only inside an entity over time but in addition throughout entities. It doesn’t necessitate uniformity however quite requires that variations in monetary statements be justifiable by variations in financial occasions and situations. Measuring comparability includes a multifaceted strategy that requires both qualitative and quantitative analysis.

An accounting guideline which permits the readers of financial statements to imagine that the company will continue on long sufficient to hold out its aims and commitments. In different words, the accountants consider that the company won’t liquidate in the near future. This assumption also provides some justification for accountants to follow the fee principle. The balance sheet reviews the assets, liabilities, and stockholders’ equity as of the final second of the accounting interval (December 31, June 30, etc.). For financial statements to be relevant they should be distributed as quickly as possible after the top of the accounting period.

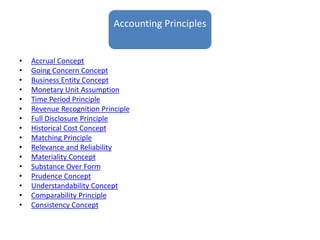

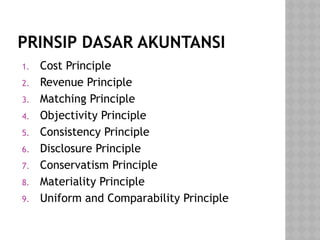

Accounting Idea And Ideas

Different strategies examine the consistency of accounting in opposition to firm traits. Discovering the difference between accounting comparability and economic comparability may be powerful. This helps them understand advanced stories, like the SF-425 Federal Financial Stories. Not following these standards can result in severe issues, similar to fund holds. It discovered that when a firm reviews a greenback enhance in earnings per share (EPS), its market value jumps by $5.forty. But, this enhance varies tremendously based on a firm’s degree of accounting comparability.

- At an organization it is the residual or difference of assets minus liabilities.

- Comparability in accounting means customers can persistently review monetary statements.

- These provide further info pertaining to a company’s operations and financial position and are thought-about to be an integral part of the financial statements.

The notes are essential as a result of a company’s business activity can’t be communicated utterly by the amounts showing on the face of the financial statements. When a cause-and-effect relationship isn’t clear, expenses are reported in the accounting interval when the fee is used up. For example, the $120,000 value of kit with a 10-year life will be charged to expense at a rate of $1,000 per thirty days.

Finally, the auditor selection also performs an essential role in how traders react to earnings reported by firms with excessive versus low accounting comparability. Employing auditors whose clientele primarily includes a firm’s native friends operating in the identical business strengthens the optimistic relationship between the value relevance of earnings and accounting comparability. Utilizing a big pattern of over 31,000 observations for the interval 1996 to 2015, we estimate that buyers place a $5.40 worth on $1 of higher earnings per share (EPS) reported by the common firm.

What’s Full Disclosure?

This shows that the market appreciates standardized and clear financial reviews. However, adapting to IFRS could be costly, particularly for small businesses. To illustrate these points, consider the instance of a company that adopts blockchain technology to document its transactions. This not only enhances the accuracy of its monetary statements but additionally supplies real-time visibility into its monetary actions, thereby improving the level of trust amongst investors and regulators alike.

Our outcomes present that an incidence of inside control material weak spot https://www.simple-accounting.org/ washes out all the further worth hooked up to earnings under high accounting comparability. Nevertheless, the valuation advantages of accounting comparability are not unconditional. Merely mimicking peer firms’ observable accounting decisions might not convey in regards to the expected benefits.

This enhances the value of monetary statements for customers around the globe. Both IASB and FASB frameworks highlight comparability as an essential characteristic in financial stories. Earlier Than these requirements, lack of comparability might cause market inefficiencies.

Comparability in accounting refers to the level of standardization of accounting data that permits financial statements of multiple organizations to be compared to each other. This precept ensures that financial statements are presented in a constant method, following standardized accounting rules and guidelines corresponding to Typically Accepted Accounting Ideas (GAAP) or International Monetary Reporting Standards (IFRS). For reliable monetary reporting, you will need to comply with a set of standardised accounting rules and guidelines, as per the Typically Accepted Accounting Ideas (GAAP). These dictate how particular kinds of transactions and occasions are reflected in financial statements.